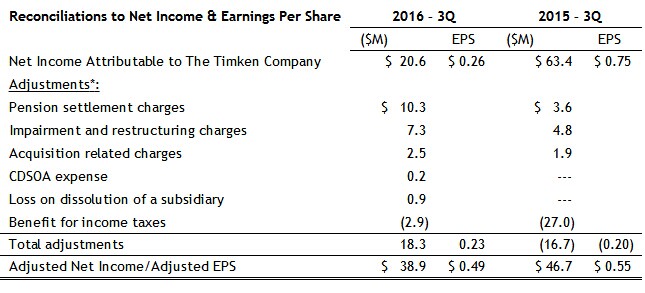

*Adjustments are pre-tax, with net tax (benefit) provision listed separately.

"We performed well again this quarter, demonstrating our ability to navigate a challenging market environment," said Richard G. Kyle, Timken president and chief executive officer. "While most industrial sectors remain weak, our earnings are on track for the year and we continue to focus on organic outgrowth initiatives, operational excellence and deploying capital to create shareholder value."

During the quarter, the company:

Completed the acquisition of Lovejoy, Inc., a manufacturer of premium industrial couplings and universal joints, further expanding its mechanical power transmission portfolio;

Continued to reduce operating costs, including the announcement of plans to close its Pulaski, Tenn., bearing plant and cease manufacturing operations in South Africa; and

Returned $35 million in capital to shareholders in the third quarter through the repurchase of 480,000 shares and the payment of its 377th consecutive quarterly dividend.

Third-Quarter Segment Results

Mobile Industries reported third-quarter sales of $353 million, 11 percent lower than the same period a year ago. Excluding unfavorable currency of 1 percent, sales were down 10 percent, as the net benefit of acquisitions were more than offset by declines across most end markets.

Earnings before interest and taxes (EBIT) in the quarter were $24.1 million or 6.8 percent of sales, compared with EBIT of $43.0 million or 10.8 percent of sales for the same period a year ago. The decrease in EBIT reflects lower volume, unfavorable price/mix and higher impairment and restructuring charges, partially offset by favorable material and manufacturing costs and lower SG&A expenses.

Excluding impairment and restructuring and other items, adjusted EBIT in the quarter was $30.6 million or 8.7 percent of sales, compared with $46.1 million or 11.6 percent of sales in the third quarter last year.

Process Industries sales of $304 million for the third quarter declined 2 percent from the same period a year ago. Excluding unfavorable currency of 1 percent, sales were down 1 percent, driven by weaker demand in heavy industries, industrial services and wind energy, partially offset by higher military marine revenue and the benefit of acquisitions.

EBIT for the quarter was $40.7 million or 13.4 percent of sales, compared with EBIT of $43.1 million or 13.9 percent of sales for the same period a year ago. The decrease in EBIT was driven by the impact of lower volume, unfavorable price/mix and charges related to the Lovejoy acquisition, partially offset by favorable material costs and lower SG&A expenses.

Excluding acquisition-related charges and other items, adjusted EBIT in the quarter was $44.2 million or 14.5 percent of sales, compared with $45.4 million or 14.7 percent of sales in the third quarter last year.

2016 Outlook

The company expects 2016 revenue to be down approximately 7 to 8 percent in total versus 2015, including an estimated unfavorable currency impact of 1.5 percent.

Within its segments, the company estimates full-year 2016:

Mobile Industries' sales to be down approximately 8 percent, including an unfavorable currency impact of 1.5 percent. The remaining decline reflects lower demand in rail, off-highway, aerospace and heavy truck, partially offset by growth in automotive and the net benefit of acquisitions.

Process Industries' sales to be down approximately 7 percent, including an unfavorable currency impact of 1.5 percent. The remaining decline reflects lower demand in heavy industries and the industrial aftermarket, partially offset by the benefit of acquisitions.

Timken anticipates 2016 earnings per diluted share to range from $1.77 to $1.83 for the full year on a GAAP basis. The company expects 2016 adjusted earnings per diluted share to range from $1.92 to $1.98.

Conference Call Information

Timken will host a conference call today at 11 a.m. Eastern Time to review its financial results. Presentation materials will be available online in advance of the call for interested investors and securities analysts.

Conference Call:

Thursday, October 27, 2016

11 a.m. Eastern Time

Live Dial-In: 877-545-1403 or 719-325-4826

(Call in 10 minutes prior to be included.)

Conference ID: Timken's 3Q Earnings Call

Live Webcast: http://investors.timken.com

Conference Call Replay:

Replay Dial-In available through November 10, 2016:

888-203-1112 or 719-457-0820

Replay Passcode: 1719432

About The Timken Company

The Timken Company (NYSE: TKR; www.timken.com) engineers, manufactures and markets bearings, gear drives, belts, chain, couplings, and related products, and offers a spectrum of powertrain rebuild and repair services. The leading authority on tapered roller bearings, Timken today applies its deep knowledge of metallurgy, tribology and mechanical power transmission across a variety of bearings and related systems to improve reliability and efficiency of machinery and equipment all around the world. The company's growing product and services portfolio features many strong industrial brands including Timken®, Fafnir®, Philadelphia Gear®, Carlisle®, Drives®, Lovejoy® and Interlube™. Known for its quality products and collaborative technical sales model, Timken posted $2.9 billion in sales in 2015. With more than 14,000 employees operating from 28 countries, Timken makes the world more productive and keeps industry in motion.

Certain statements in this release (including statements regarding the company's forecasts, estimates plans and expectations) that are not historical in nature are "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995. In particular, the statements related to expectations regarding the company's future financial performance, including information under the heading "Outlook," are forward-looking.

The company cautions that actual results may differ materially from those projected or implied in forward-looking statements due to a variety of important factors, including: the finalization of the company's financial statements for the third quarter of 2016; the company's ability to respond to the changes in its end markets that could affect demand for the company's products; unanticipated changes in business relationships with customers or their purchases from the company; changes in the financial health of the company's customers, which may have an impact on the company's revenues, earnings and impairment charges; fluctuations in raw material and energy costs; the impact of changes to the company's accounting methods; weakness in global or regional economic conditions and capital markets; fluctuations in currency valuations; changes in the expected costs associated with product warranty claims; the ability to achieve satisfactory operating results in the integration of acquired companies; the impact on operations of general economic conditions; fluctuations in customer demand; the impact on the company's pension obligations due to changes in interest rates, investment performance and other tactics designed to reduce risk; the company's ability to complete and achieve the benefits of announced plans, programs, initiatives, and capital investments; and retention of U.S. Continued Dumping and Subsidy Offset Act distributions. Additional factors are discussed in the company's filings with the Securities and Exchange Commission, including the company's Annual Report on Form 10-K for the year ended Dec. 31, 2015, quarterly reports on Form 10-Q and current reports on Form 8-K. Except as required by the federal securities laws, the company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Media Relations:

234.262.3514

mediarelations@timken.com

Investor Relations:

Jason Hershiser

234.262.7101

jason.hershiser@timken.com

*Adjustments are pre-tax, with net tax (benefit) provision listed separately.

"We performed well again this quarter, demonstrating our ability to navigate a challenging market environment," said Richard G. Kyle, Timken president and chief executive officer. "While most industrial sectors remain weak, our earnings are on track for the year and we continue to focus on organic outgrowth initiatives, operational excellence and deploying capital to create shareholder value."

During the quarter, the company:

Completed the acquisition of Lovejoy, Inc., a manufacturer of premium industrial couplings and universal joints, further expanding its mechanical power transmission portfolio;

Continued to reduce operating costs, including the announcement of plans to close its Pulaski, Tenn., bearing plant and cease manufacturing operations in South Africa; and

Returned $35 million in capital to shareholders in the third quarter through the repurchase of 480,000 shares and the payment of its 377th consecutive quarterly dividend.

Third-Quarter Segment Results

Mobile Industries reported third-quarter sales of $353 million, 11 percent lower than the same period a year ago. Excluding unfavorable currency of 1 percent, sales were down 10 percent, as the net benefit of acquisitions were more than offset by declines across most end markets.

Earnings before interest and taxes (EBIT) in the quarter were $24.1 million or 6.8 percent of sales, compared with EBIT of $43.0 million or 10.8 percent of sales for the same period a year ago. The decrease in EBIT reflects lower volume, unfavorable price/mix and higher impairment and restructuring charges, partially offset by favorable material and manufacturing costs and lower SG&A expenses.

Excluding impairment and restructuring and other items, adjusted EBIT in the quarter was $30.6 million or 8.7 percent of sales, compared with $46.1 million or 11.6 percent of sales in the third quarter last year.

Process Industries sales of $304 million for the third quarter declined 2 percent from the same period a year ago. Excluding unfavorable currency of 1 percent, sales were down 1 percent, driven by weaker demand in heavy industries, industrial services and wind energy, partially offset by higher military marine revenue and the benefit of acquisitions.

EBIT for the quarter was $40.7 million or 13.4 percent of sales, compared with EBIT of $43.1 million or 13.9 percent of sales for the same period a year ago. The decrease in EBIT was driven by the impact of lower volume, unfavorable price/mix and charges related to the Lovejoy acquisition, partially offset by favorable material costs and lower SG&A expenses.

Excluding acquisition-related charges and other items, adjusted EBIT in the quarter was $44.2 million or 14.5 percent of sales, compared with $45.4 million or 14.7 percent of sales in the third quarter last year.

2016 Outlook

The company expects 2016 revenue to be down approximately 7 to 8 percent in total versus 2015, including an estimated unfavorable currency impact of 1.5 percent.

Within its segments, the company estimates full-year 2016:

Mobile Industries' sales to be down approximately 8 percent, including an unfavorable currency impact of 1.5 percent. The remaining decline reflects lower demand in rail, off-highway, aerospace and heavy truck, partially offset by growth in automotive and the net benefit of acquisitions.

Process Industries' sales to be down approximately 7 percent, including an unfavorable currency impact of 1.5 percent. The remaining decline reflects lower demand in heavy industries and the industrial aftermarket, partially offset by the benefit of acquisitions.

Timken anticipates 2016 earnings per diluted share to range from $1.77 to $1.83 for the full year on a GAAP basis. The company expects 2016 adjusted earnings per diluted share to range from $1.92 to $1.98.

Conference Call Information

Timken will host a conference call today at 11 a.m. Eastern Time to review its financial results. Presentation materials will be available online in advance of the call for interested investors and securities analysts.

Conference Call:

Thursday, October 27, 2016

11 a.m. Eastern Time

Live Dial-In: 877-545-1403 or 719-325-4826

(Call in 10 minutes prior to be included.)

Conference ID: Timken's 3Q Earnings Call

Live Webcast: http://investors.timken.com

Conference Call Replay:

Replay Dial-In available through November 10, 2016:

888-203-1112 or 719-457-0820

Replay Passcode: 1719432

About The Timken Company

The Timken Company (NYSE: TKR; www.timken.com) engineers, manufactures and markets bearings, gear drives, belts, chain, couplings, and related products, and offers a spectrum of powertrain rebuild and repair services. The leading authority on tapered roller bearings, Timken today applies its deep knowledge of metallurgy, tribology and mechanical power transmission across a variety of bearings and related systems to improve reliability and efficiency of machinery and equipment all around the world. The company's growing product and services portfolio features many strong industrial brands including Timken®, Fafnir®, Philadelphia Gear®, Carlisle®, Drives®, Lovejoy® and Interlube™. Known for its quality products and collaborative technical sales model, Timken posted $2.9 billion in sales in 2015. With more than 14,000 employees operating from 28 countries, Timken makes the world more productive and keeps industry in motion.

Certain statements in this release (including statements regarding the company's forecasts, estimates plans and expectations) that are not historical in nature are "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995. In particular, the statements related to expectations regarding the company's future financial performance, including information under the heading "Outlook," are forward-looking.

The company cautions that actual results may differ materially from those projected or implied in forward-looking statements due to a variety of important factors, including: the finalization of the company's financial statements for the third quarter of 2016; the company's ability to respond to the changes in its end markets that could affect demand for the company's products; unanticipated changes in business relationships with customers or their purchases from the company; changes in the financial health of the company's customers, which may have an impact on the company's revenues, earnings and impairment charges; fluctuations in raw material and energy costs; the impact of changes to the company's accounting methods; weakness in global or regional economic conditions and capital markets; fluctuations in currency valuations; changes in the expected costs associated with product warranty claims; the ability to achieve satisfactory operating results in the integration of acquired companies; the impact on operations of general economic conditions; fluctuations in customer demand; the impact on the company's pension obligations due to changes in interest rates, investment performance and other tactics designed to reduce risk; the company's ability to complete and achieve the benefits of announced plans, programs, initiatives, and capital investments; and retention of U.S. Continued Dumping and Subsidy Offset Act distributions. Additional factors are discussed in the company's filings with the Securities and Exchange Commission, including the company's Annual Report on Form 10-K for the year ended Dec. 31, 2015, quarterly reports on Form 10-Q and current reports on Form 8-K. Except as required by the federal securities laws, the company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Media Relations:

234.262.3514

mediarelations@timken.com

Investor Relations:

Jason Hershiser

234.262.7101

jason.hershiser@timken.com

Tel:86-21-55155796;86-21-63563197

Fax:86-21-63561543

Address:No. 3978, Baoan Highway, Anting Town, Jiading District, Shanghai

Email:wf@wfbearings.com

Website:www.cjcpx.com www.wfbearings.com

Mobile Site

Mobile Site